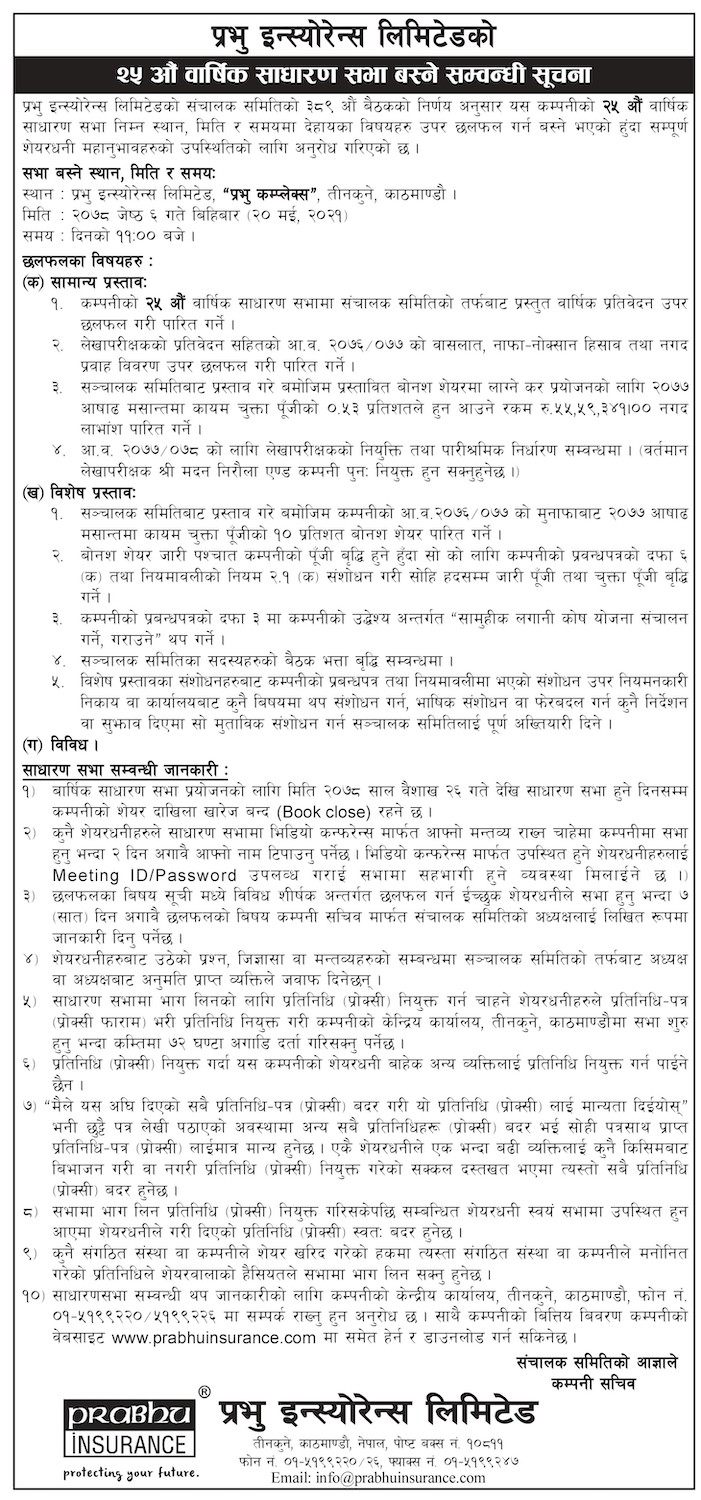

| S.N |

Particular |

Indicators |

Fiscal Year |

|

|

|

|

| |

|

|

2079/80 |

2078/79 |

2077/78 |

2076/77 |

2075/76 |

| 1 |

Net worth |

NPR |

2,657,461,190.08 |

2,380,722,359.00 |

2,200,394,452.00 |

1,975,358,553.00 |

1,849,452,766.00 |

| 2 |

Number of Shares |

No.s |

13,761,222.60 |

12,897,116.00 |

11,619,023.28 |

10,562,748.44 |

10,050,759.00 |

| 3 |

Book value per shares |

NPR |

193.11 |

185.00 |

189.00 |

184.00 |

211.00 |

| 4 |

Net Profit |

NPR |

225,046,535.07 |

186,125,748.00 |

223,514,216.00 |

258,442,350.00 |

257,418,053.00 |

| 5 |

Earning per Shares (EPS) |

NPR |

16.35 |

14.00 |

19.00 |

24.00 |

24.00 |

| 6 |

Dividend per Shares (DPS) |

NPR |

5.00 |

7.05 |

11.58 |

10.53 |

16.32 |

| 7 |

Market Price per Shares (MPPS) |

NPR |

747.00 |

428.00 |

960.00 |

493.00 |

364.00 |

| 8 |

Price Earning Ratio (PE Ratio) |

Ratio |

45.68 |

30.00 |

50.00 |

20.00 |

15.20 |

| 9 |

Change in Equity |

% |

11.62% |

8.20% |

11.39% |

6.81% |

27.15% |

| 10 |

Return on Equity |

% |

8.47% |

14.00% |

19.00% |

26.00% |

35.00% |

| 11 |

Capital to Total Net Assets Ratio |

% |

28.09% |

29.71% |

27.58% |

30.69% |

35.18% |

| 12 |

Capital to Technical Reserve Ratio |

% |

86.02% |

74.99% |

65.95% |

94.43% |

126.24% |

| 13 |

Affiliate Ratio |

% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

| 14 |

Net Premium Growth Rate |

% |

10% |

1% |

-5% |

10% |

18% |

| 15 |

Net Insurance Premium/ Gross Insurance Premium |

|

|

|

|

|

|

| 16 |

Reinsurance Commission Income/ Gross Reinsurance Premium |

% |

20% |

15% |

18% |

21% |

38% |

| 17 |

Gross Premium Revenue/ Equity |

% |

59% |

1% |

1% |

1% |

1% |

| 18 |

Net Premium Revenue/ Equity |

% |

21% |

22% |

23% |

28% |

32% |

| 19 |

Gross Insurance Premium/Total Assets |

% |

31% |

32% |

34% |

37% |

37% |

| 20 |

Return on Investments |

% |

5% |

5% |

5% |

6% |

6% |

| 21 |

Net Profit/ Gross Insurance Premium |

% |

14% |

13% |

15% |

25% |

27% |

| 22 |

Reinsurance Ratio |

% |

67% |

67% |

57% |

70% |

50% |

| 23 |

Management expenses/ Gross Insurance Premium |

% |

17% |

16% |

13% |

20% |

18% |

| 24 |

Agent Related Expenses/ Gross Insurance Premium |

% |

2% |

2% |

2% |

3% |

2% |

| 25 |

Agent Related Expenses/Management Expenses |

% |

0% |

|

|

|

|

| 26 |

Employee Expenses/ Management Expenses |

% |

79% |

62% |

70% |

63% |

82% |

| 27 |

Employee Expenses/ Number of Employees |

Amt. |

1,032,915.74 |

584,648.00 |

646,825.00 |

774,276.00 |

802,953.00 |

| 28 |

Expense Ratio (Underwriting Expense/Net Written Premium) |

% |

52% |

6% |

7% |

6% |

52% |

| 29 |

Commission Ratio (Commission Expense/Net Written Premium) |

% |

6% |

54% |

48% |

44% |

41% |

| 30 |

Loss Ratio {(Claim Paid + change in reserve)/ (Net Written Premium)} |

% |

16% |

48% |

42% |

37% |

36% |

| 31 |

Combined Ratio (Loss Ratio + Expense Ratio)’ |

% |

34% |

54% |

48% |

44% |

41% |

| 32 |

Increment in Investment Held |

% |

34.11% |

4.92% |

5.27% |

5.93% |

5.28% |

| 33 |

Return on Assets |

% |

4.47% |

5.00% |

4.00% |

7.00% |

9.00% |

| 34 |

Long term Investments/Total Investments |

% |

28.20% |

28.15% |

29.45% |

29.90% |

30.00% |

| 35 |

Short term Investments/Total Investments |

% |

71.80% |

69.05% |

70.55% |

70.10% |

70.00% |

| 36 |

Total Investment & Loan/Gross Insurance Contract Liabilities |

% |

119.99% |

83.00% |

73.00% |

81.00% |

88.00% |

| 37 |

Investment in Unlisted Shares and Debtors/ Total Net Assets |

% |

2.79% |

4.79% |

11.24% |

10.56% |

9.36% |

| 38 |

Investment in Shares/ Total Net Assets |

% |

8.93% |

21.00% |

23.00% |

21.00% |

21.00% |

| 39 |

Liquidity Ratio |

% |

9.64% |

24.00% |

52.00% |

24.00% |

35.00% |

| 40 |

Solvency Margin |

% |

1.94% |

1.73% |

2.27% |

1.55% |

1.54% |

| 41 |

Increment in Gross Insurance Contract Liabilities |

% |

-7% |

3% |

58% |

40% |

16% |

| 42 |

Net Technical Reserve/ Average of Net Claim Paid for Last 3 Years |

% |

-53% |

46% |

37% |

29% |

36% |

| 43 |

Actuarial Provision |

Amt. |

102,398,324.00 |

83,201,225.00 |

62,074,550.00 |

61,250,745.00 |

48,670,495.00 |

| 44 |

Technical Provisions/ Total Equity |

% |

4% |

3% |

3% |

3% |

3% |

| 45 |

Insurance Debt/ Total Equity |

% |

37% |

2% |

3% |

5% |

1% |

| 46 |

Outstanding Claim/ Claim Intimated |

% |

41% |

38% |

38% |

29% |

37% |

| 47 |

No. of Outstanding Claim/ No. of Intimated Claim |

% |

10% |

14% |

48% |

61% |

57% |

| 48 |

Total Number of Inforce Policies |

No.s |

180,630.00 |

120,455.00 |

96,267.00 |

72,100.00 |

86,243.00 |

| 49 |

Number of Renewed Policy/ Last Year’s Total Number of In Force Policies |

% |

27% |

30% |

23% |

22% |

20% |

| 50 |

Number of Intimated Claim/ Total Number of In Force Policy |

% |

12% |

19% |

14% |

8% |

8% |

| 51 |

Number of Offices |

No.s |

55 |

55.00 |

54.00 |

51.00 |

44.00 |

| 52 |

Number of Agents |

No.s |

172 |

158.00 |

123.00 |

64.00 |

69.00 |

| 53 |

Number of Surveyor |

No.s |

288 |

220.00 |

187.00 |

156.00 |

145.00 |

| 54 |

Number of Employees |

No.s |

252 |

236.00 |

212.00 |

180.00 |

168.00 |